bank of canada interest rate announcement dates 2022

The present operational activities as a central bank differ from those during the 19th century. The Toronto-based lender is now projecting the Bank of Canada will hike its overnight policy rate to 2 per cent in 2022 from the current emergency level of 025 per cent according to a report published Wednesday shortly after Statistics Canada said inflation hit its highest in three decades.

Higher Interest Rates Are Coming Omicron Is Unlikely To Change That Cbc News

Best balance transfer rate in Canada.

. Federal Internship Program FIP Federal Bank invites aspiring young talented and dynamic minds to make their next two years most fruitful through learning earning and gaining strong experience in Retail Banking to join Federal Internship Program. You can get a 0 promotional balance transfer rate for 12 months to help you pay off pre-existing credit card debt. Follow our latest coverage of business markets and economy.

Regulators have called for a market-wide transition away from new LIBOR exposures by the end of 2021. GMT via pdf format to ndmpnbppl. The Swiss National Bank held its policy rate at -075 and the interest rate it charges on overnight deposits it holds for commercial banks at -075 at its December 2021 meeting as expected.

The JPY RFR Working Group part of the Bank of Japan BoJ released an announcement in late July on TONA First go-live dates and scope of products. An FDIC-insured bank deposit account where you agree to keep the money on deposit for a specified period of time usually anywhere from three months to several years. Upward of two dozen policy announcement will be made across the globe in the next five days headlined by the US.

The World Bank warns that the pandemic will slow economic growth in 2022. The announcement triggers the calculation and fixing of spread adjustments that are intended to account for the economic differences between LIBORs and their risk-free rate RFR replacements. It recommended that JPY Interest Rate Swaps IRS linear products carried out in the interbank market via voice brokers should be ceased altogether after 30 July 2021.

In exchange the interest rate paid is usually higher than the rate paid on savings accounts. 0 interest for 12 months with Canadas 1 balance transfer promotion 40 GeniusCash. With regard to interest rate hikes by the Bank of Canada this year Opposition Leader Erin OToole seems to believe the Bank of Canada will hike rates four times this year ie.

Federal Reserve European Central. It does this by adjusting the target for the overnight rate on eight fixed dates each year. The Bank carries out monetary policy by influencing short-term interest rates.

Delta Air Lines and a union spar over isolation periods for. The resulting average rate is usually abbreviated to Libor ˈ l aɪ b ɔːr or LIBOR or more officially to ICE LIBOR for Intercontinental Exchange Libor. Exchange rate regimes and economic adjustment Inflation in the post-pandemic world Platformification of finance.

Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more. An average of once every two interest rate announcement dates. The position of the Riksbank as a central bank dates back to 1897 when the first Riksbank Act was accepted concurrently with a law giving the Riksbank the exclusive right to issue bank.

The London Inter-Bank Offered Rate is an interest-rate average calculated from estimates submitted by the leading banks in LondonEach bank estimates what it would be charged were it to borrow from other banks. Policymakers said they are maintaining its ultra-loose monetary policy with a view to ensuring price stability and providing ongoing support to the Swiss economy despite rising inflation and. For example no interest-rate-related activities were conducted.

The Bank of Canada is one of few major central banks not releasing a decision this week. The global financial industry is preparing to transition away from a key benchmark interest rate the London Interbank Offered Rate or LIBOR to new alternative rates. These adjustments include approaches such as a 5 year historical median of the difference between the two relevant rates.

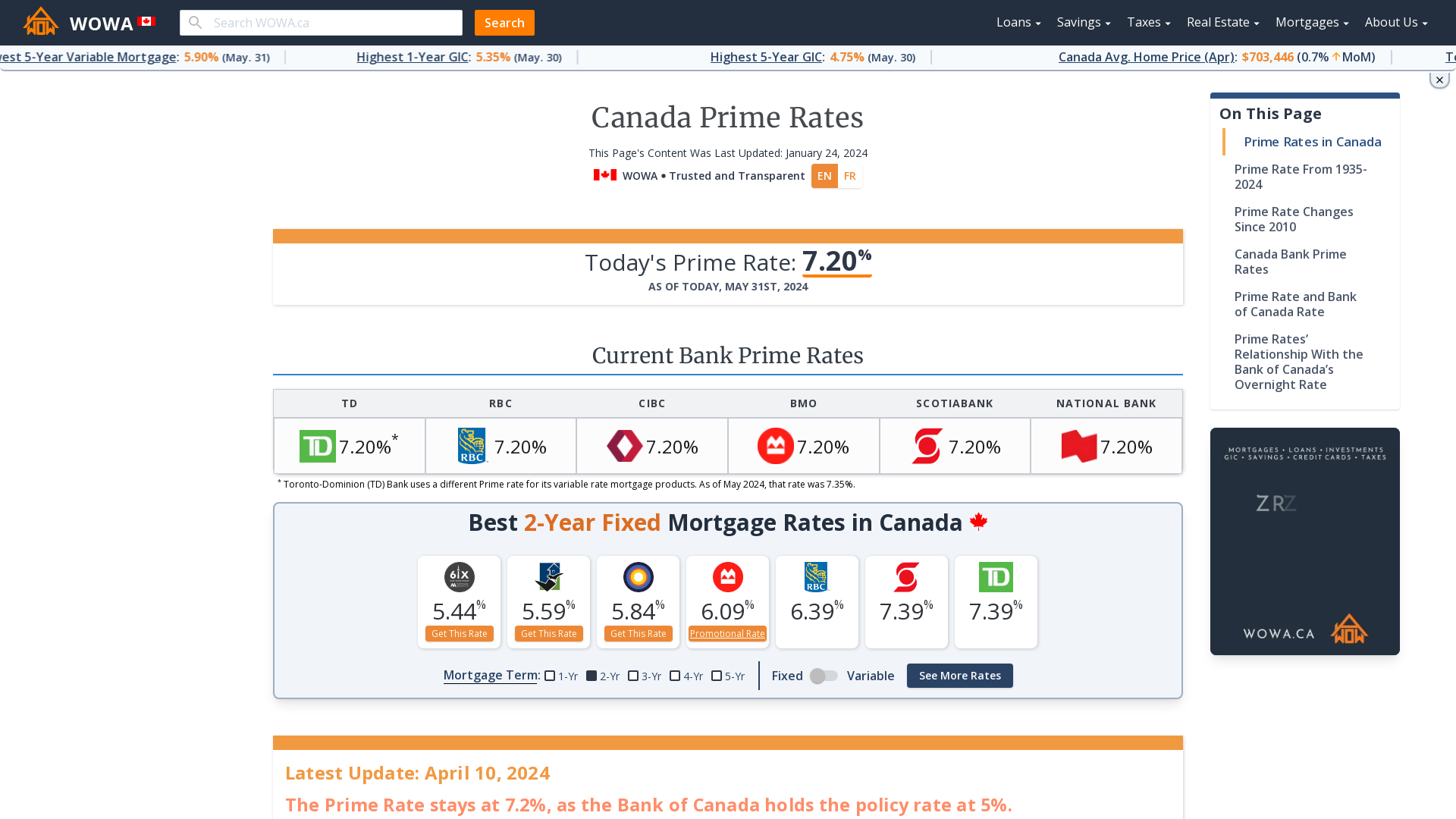

15 May and closes 1 June 2022. Contributors will be notified by 5 May 2022. The Bank of Canada today published its 2022 schedule for policy interest rate announcements and the release of the quarterly Monetary Policy Report.

Paper submission deadline 3 May 2022 6 pm. Accounts with higher balances and longer terms may earn higher rates. It also reconfirmed the scheduled interest rate announcement dates for the remainder of this year.

Since the Bank of Canada doesnt go in for micro-adjustments this means he sees four increases of 25. Permanent low interest rates of 1299 on purchases and balance transfers 2499 on cash advances. Policy Interest Rate - Bank of Canada.

Canada Unemployment Rate 2026 Statista

Jydq7dfiku Fym

4ulxy06rkzbotm

Bank Of Canada Interest Rate 1935 2021 2022 Forecast Wowa Ca